what are roll back taxes in sc

When a property is classified as agricultural use and receives an exemption on the property taxes due these taxes are considered deferred. What are rollback taxes.

International Roll Back Tow Trucks For Sale 90 Listings Marketbook Ca Page 1 Of 4

They are based on the difference between the tax paid and the tax that would have been paid if an agricultural use exemption had not been granted.

. The Rollback tax is a requirement codified in South Carolina state law. The Rollback tax is a requirement codified in South Carolina state law. In South Carolina there is no rule as to whether the purchaser or seller pays the rollback tax.

Each years tax is based upon the years appraisal and millage rate. Anytime a property changes its use from agricultural use to any other use it causes rollback taxes to be assessed and billed to that portion of the property. The majority of the use changes involve new houses.

Rollback taxes are calculated on the difference between what was paid under agricultural use verses what would have been paid as nonagricultural property. If the parties involved and. In South Carolina there is no rule as to whether the purchaser or seller pays the rollback tax.

In the year the use changes the difference between tax paid under the agricultural use classification and the amount that would have been paid typically as commercial under full FMV is the rollback taxes and up until January 1 2021 it is calculated. SC REALTORSR Potentially Got Rollback Tax Savings for Buyers Consider Close in 2021. The appraiser must determine the amount of the property that must be changed and then roll-back taxes are applied for up to five years.

Roll-Back Taxes are applied when all or a portion of a property that has been receiving the Agricultural Use Value changes classification. Under prior law rollback taxes were accessed for a five-year period. Rollback Taxes What are Rollback Taxes.

When real property which has been classified as agricultural use is being valued assessed and taxed as such is applied to a use other than agricultural it is subject to additional taxes referred to as rollback taxes. The appraiser must determine the amount of the property that must be changed and then roll-back taxes are. Rollback taxes were changed from 5 years to 3 years in a bill signed by the Governor in September 2020.

When a change in use of the property occurs such as a new building on the property then the Assessors Office must go back up to a period of five 5 years and. An example would be when a property owner of land that is in Agricultural use builds a new house that is for residential use. Changes that can trigger the rollback provision may.

South Carolina Code Section 12-43-220 was amended in this years shortened legislative session to reduce the lookback period to three years. 4 Except as provided pursuant to Section 12-43-222 when real property which is in agricultural use and is being valued assessed and taxed under the provisions of this article is applied to a use other than agricultural it is subject to additional taxes hereinafter referred to as roll-back rollback taxes in an amount equal to the difference if any between the taxes paid or. Contact the Lexington County Tax Assessor 803 785-8190 for the following.

When a change in use of the property occurs such as a new building on the property then the Assessors Office must go back up to a period of five 5 years and collect those deferred taxes. If the parties involved and their lawyers are aware of this issue upfront the payment of rollback taxes typically is negotiated prior to execution of the contract. Rollback Taxes Frequently Asked Questions.

A Brief Explanation The Rollback tax is a requirement codified in South Carolina state law. What are rollback taxes. Changes that can trigger the rollback provision may be the addition of a new house or mobile home.

When a property is classified as agricultural use and receives an exemption on the property taxes due these taxes are considered deferred. For changes of address for real property Real Estate Refund Requests. To inquire about appraisal values on real property.

When real property valued and assessed as agricultural property is changed to a use other than agricultural it is subject to additional taxes referred to as rollback taxes. When agricultural real property is applied to a use other than agricultural it becomes subject to rollback taxes. SC REALTORS worked to get changes to state laws in 2020.

What are rollback taxes. The payment of any roll-back taxes assessed against the Property under the roll-back provisions of Section 12-43-220d4 of the Code of Laws of South Carolina 1976 as amended shall be the responsibility of Buyer. Questions regarding Rollback Taxes.

Anytime a property changes its use from agricultural use to any other use it causes rollback taxes to be assessed and billed to that portion of the property. Primary residence farm or agricultural exemption discounts. Who pays the rollback tax.

The agreements of Buyer and Seller set forth in this Section 8b shall survive the Closing. Typically rollback taxes apply in transactions in which a developer is purchasing property for development that previously received the benefit of an agricultural use special assessment ratio property tax exemption. ROLL-BACK TAXES Roll-Back Taxes are applied when property that has been receiving the Use Value classification and the use of a portion or all of the property has changed.

5693-712 4981 Rollback tax Rollback tax can go back 3 years. The rollback taxes can be applied to the property. South Carolina Code Section 12-43-220 was amended in this years shortened legislative session to reduce the lookback period to three years.

Anytime a property changes its use from agricultural use to any other use it causes rollback taxes to be assessed and billed to that portion of the property. Rollback taxes are assessed when the use of property that has been taxed as agricultural rate changes. Greenville SC 29601 Telephone 864-467-7300 REQUEST FOR ROLL-BACK TAX BILL AND AUTHORIZATION TO RELEASE INFORMATION A Separate Request Is Required For Each Tax Map Number The undersigned hereby authorizes the Greenville County Tax Collector and Greenville County Real Property Services to issue a bill for the deferred taxes on property known as.

Under prior law rollback taxes were accessed for a five-year period. The applicable South Carolina county will not prorate rollback taxes between purchasers and sellers. South Carolina Code Section 12-43-220 requires that any time a property changes from receiving the benefit of an agricultural use special assessment ratio property tax.

Rollback taxes are assessed when the use of property that has been taxed as agricultural rate changes. If real property including mobile home has been sold. 2020 Year Millage Rate 6.

A rollback tax is collected when properties change from agricultural to commercial or residential use. 4A Except as provided pursuant to Section 12-43-222 when real property which is in agricultural use and is being valued assessed and taxed under the provisions of this article is applied to a use other than agricultural it is subject to additional taxes hereinafter referred to as roll-back taxes in an amount equal to the difference if any between the taxes paid or.

Ci 121 Montana S Big Property Tax Initiative Explained

Republicans Pledge Unified Fight To Protect 2017 Trump Tax Cuts Npr

Peterbilt Roll Back Tow Trucks For Sale 14 Listings Truckpaper Com Page 1 Of 1

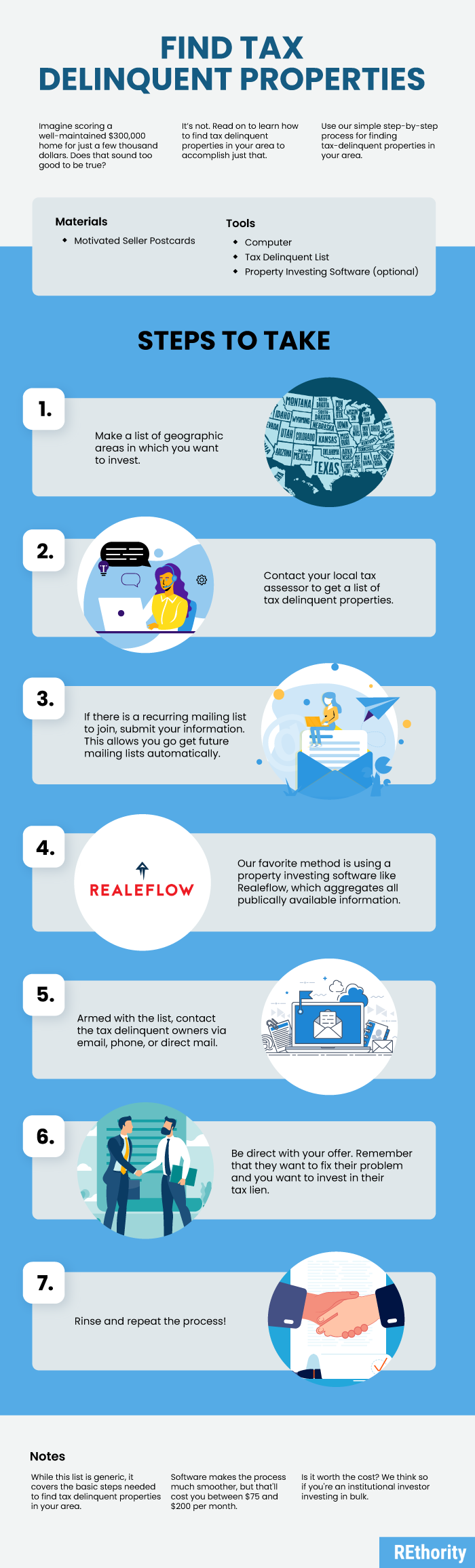

How To Find Tax Delinquent Properties In Your Area Rethority

I Didn T See The Rolling Stones But I Did Go To Concerts At The Capital Centre It Is No Longer The Rolling Stones Concert Rolling Stones Concert Tickets

Roll Back Tow Trucks For Sale In Georgia 6 Listings Truckpaper Com Page 1 Of 1

Umair On Instagram Introducing Another Oc Jormungandr Lokison I Was Getting More Into Norse Mythology And I Figured I Drawings Anime Sketch Cool Drawings

Ford F750 Roll Back For Sale 1 Listings Truckpaper Com Page 1 Of 1

و لنا في الخيال حياة Photo Art Movie Posters

Kenworth Roll Back Tow Trucks For Sale 2 Listings Truckpaper Com Page 1 Of 1

How To Find Tax Delinquent Properties In Your Area Rethority

Sc Allows Over 2000cc Diesel Vehicles In Delhi Imposes 1 New Tax The Supreme Court Has Announced That The Ab Buy Used Cars Diesel Cars Automotive Repair Shop

Pride Movie Poster Gallery Pride Movie Free Movies Online Pride 2014 Film

Freightliner Roll Back Tow Trucks For Sale 20 Listings Truckpaper Com Page 1 Of 1

Peterbilt Roll Back Tow Trucks For Sale 15 Listings Marketbook Ca Page 1 Of 1

Woman Face Id Modern Concept Smartphone Scans A Woman Face Facial Recognition Spon Smartphone Concept Woman Sc Woman Face Face Id Face Recognition

Bts Logo Inspired Canvas Acrylic Painting Bts Wall Decor Etsy Wall Art Lighting Painting Diy Art Painting